War with ClearScore: How Affordability Modelling Misled the Consumer

This entry documents a dispute with ClearScore concerning how it handled a challenge to inaccurate credit information displayed through its platform. The issue examined here is not simply the presence of incorrect data, but how ClearScore responded once those inaccuracies were raised — including its approach to investigation, accountability, and responsibility within the UK credit reporting ecosystem.

Context

ClearScore positions itself as a consumer-focused credit reporting platform, marketed as a tool to help individuals understand, monitor, and improve their credit position. It presents aggregated credit data in a simplified form and encourages users to rely on that information when assessing their financial standing.

In doing so, ClearScore occupies an intermediary role: it selects, displays, and contextualises credit data sourced from third parties, while presenting itself as an accessible point of engagement for consumers who identify inaccuracies.

In this case, credit information displayed via ClearScore was challenged as inaccurate. The issue that followed was not limited to whether the data was correct, but how ClearScore handled the challenge once raised — including whether it assessed accuracy, what responsibility it accepted, and how it communicated the limits of its role to the consumer.

This dispute therefore concerns the practical gap between ClearScore’s consumer-facing positioning and the way responsibility is handled when data accuracy is questioned.

What was challenged

The challenge raised with ClearScore related to specific credit information displayed on the platform that was demonstrably inaccurate when compared against underlying records.

The issue was raised clearly, with reference to the relevant data points, and did not seek discretionary interpretation or special treatment. It sought only confirmation that inaccurate information would not continue to be presented as factual while unresolved.

At the point the challenge was raised, the inaccuracy was capable of being investigated and assessed without reliance on conjecture or subjective judgement.

ClearScore handling

ClearScore’s response relied primarily on deflection of responsibility. Rather than demonstrating that it had assessed the accuracy of the information it was displaying, responsibility was redirected to the original data provider.

While ClearScore continued to present the disputed information to the consumer, it did not explain how it satisfied itself that the data met the standard of accuracy expected when providing credit information to users.

In practice, this created a circular process in which the consumer was required to pursue correction elsewhere, while ClearScore retained the benefit of presenting the data without accepting responsibility for its accuracy.

ClearScore final response

ClearScore acknowledged the dispute and responded within its standard process framework. However, the substance of the response did not resolve the underlying inaccuracies.

The response relied primarily on referral back to the original data source, without demonstrating that ClearScore itself had assessed the accuracy of the information being displayed, or evaluated whether the disputed data met the standard of accuracy required when presented to consumers.

In practice, responsibility for resolution appeared fragmented. The dispute process resulted in circular referrals between parties, while the inaccurate data remained visible.

Why this matters to millions of UK citizens

Platforms such as ClearScore position themselves as consumer tools designed to improve transparency and understanding within the credit system. That positioning carries an implicit expectation that challenges to accuracy will be meaningfully assessed.

Where responsibility is disclaimed at the point inaccuracies are raised — while disputed data continues to be displayed — the consumer is left navigating a fragmented system without a clear point of accountability. They may reasonably believe their credit position is negatively affected, when the opposite may in fact be true.

This case highlights the tension between how credit reporting platforms present their role to consumers and how responsibility is handled in practice when accuracy is questioned.

Current status

At the time of publication, this dispute is partially addressed. A formal complaint under ClearScore’s complaints procedure was upheld in full and the matter has been referred to the Financial Conduct Authority for intelligence purposes, and a reference number has been provided.

This entry reflects the position as of February 2026 and will be updated if the position materially changes.

Key themes:

Credit data accuracy · Consumer disputes · UK credit reporting · Regulatory accountability

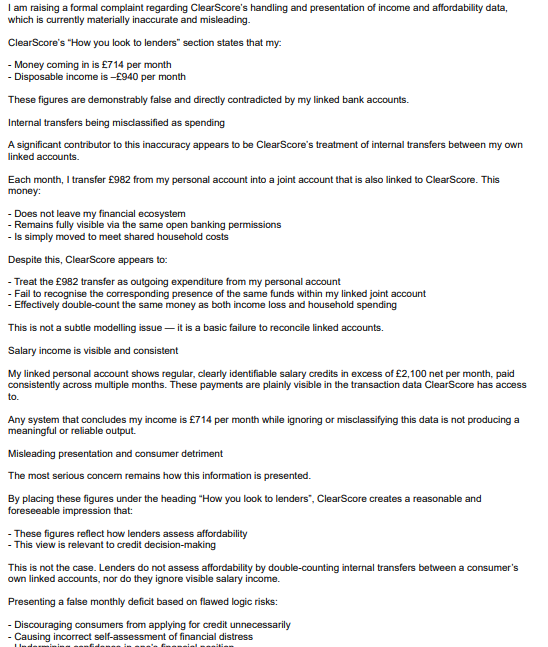

Complaint page 1

Complaint page 2

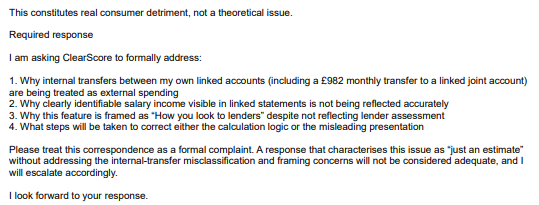

Additional concerns

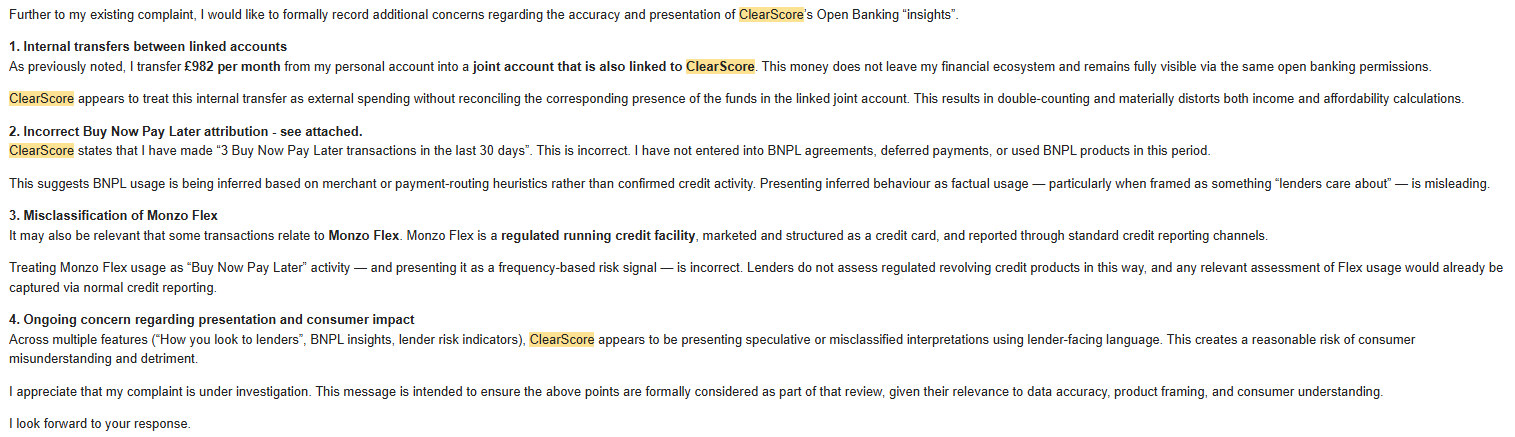

ClearScore final response page 1 of 2

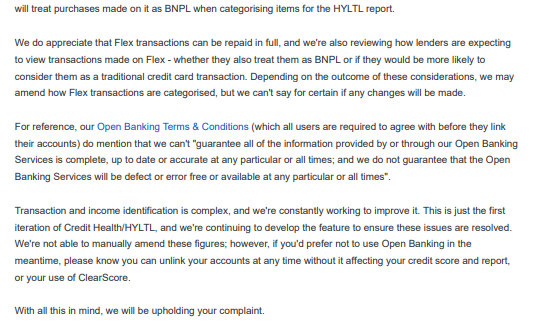

ClearScore final response page 2 of 2